Have you ever set out on a monthly savings plan with the best of intentions, only to fall short of your goal by the end of the month? Or have you ever found yourself living paycheck to paycheck despite having a great job, and wonder where all of the money goes? I want to take a moment to share something that has been foundational to my success, not only as an investor, but also as an advisor to my clients. It’s a concept called “paying yourself first.” While it may not seem revolutionary at face value, paying yourself first can have a huge impact not only on sticking to your short-term savings plan, but also on reaching your long-term financial goals. Even more, paying yourself first has the potential to significantly improve your quality of life.

A Recipe for Mediocrity

Most people approach budgeting/saving in roughly the same way. Sometimes it starts with a crisis moment, such as an argument with a spouse or an embarrassing missed payment, while other times it might be the result of a nagging sensation that things “just aren’t on track.” At any rate, we as budgeters sit down at the proverbial dining room table and take stock of all of our expenses – mortgage/rent, utilities, loans, groceries, vacation, etc. After performing some calculations that we probably haven’t used since high school, we finally get to the question on how much “should” be saved. After some quick revisions to our original columns, we settle on our magic formula and call it a day. Unfortunately, being fallible human beings, we wind up having trouble sticking to our original budget. We overspend and make allowances for ourselves, and after some questionable mental accounting we discover we don’t have as much as we originally thought to put towards our savings account. “Oh well,” we tell ourselves, “I’ll just have to do better next month.”

“Don’t save what is left after spending; spend what is left after saving.”

– Warren Buffett

Hamster Wheel Budgeting

If the scenario above hits too close to home, you are certainly not in the minority. But this approach to budgeting and saving ultimately leads to a number of problems: perpetually kicking the can down the road, a healthy amount of guilt, and end state that you never quite reach your financial goals. Even if your financial situation improves, for example you get a new job with a higher salary or your business begins to grow, you may find that you still aren’t able to save as much as you know you should. And while your day-to-day or month-to-month might not change that much (you’re still able to go out to eat or go to the movies when you want), when it comes time to make your next purchase or life decision (car, vacation, home, retirement, etc.), you discover your savings just can’t quite support it. So what is the solution?

Breaking the Cycle

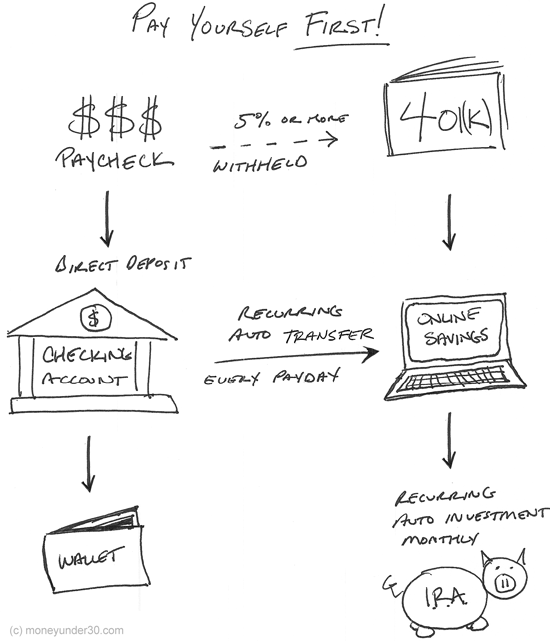

Enter the concept of paying yourself first. It’s a fundamental paradigm shift that will change the way you budget. Rather than allocating what little you have left at the end of the month, you prioritize your savings first. So, if your goal is to save ten percent of your paycheck per month, you treat those as if they were your most important payments. A great way to do this is to set up automatic withdrawals in your checking account that correspond to when you get paid. There are different ways to do this based on your unique financial needs, but let’s take a look at the example below from moneyunder30.com. In this case, half of your savings would go through your company sponsored 401k and the remainder would go into an individual brokerage account:

Who’s Working for Whom?

The real magic of paying yourself first is what this concept eventually allows you to do. By prioritizing your financial future as your most important investment, you can ultimately stop working for money and let your money work for you. At a certain point you will have accrued enough investments to where your recurring income will allow you a new level of flexibility. With the additional income and breathing room in your budget, maybe you can make the career switch you had always been dreaming of, start your own business without being crippled by risk, or maybe devote some extra time to giving back to the community.

Conclusion

Focus on you and your family as your most important budget category/investment instead of settling for whatever is left at the end of the month. Pay yourself first and you will begin to realize your long-term financial goals.

Do you need professional financial advice? I help individuals and families achieve their lifestyle and financial goals through active money management based on extensive corporate finance experience. Call me at (615) 905-5706 or email me at [email protected] to set up an interview to discuss your financial goals.