Week of May 15-19, 2017

Equities

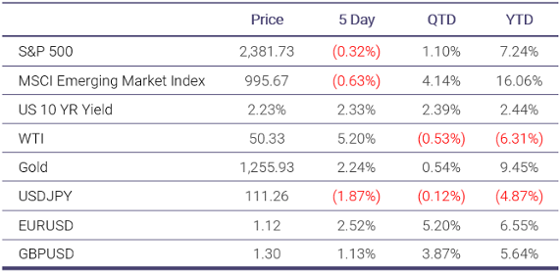

- The S&P 500 decreased by 0.32% last week after a volatile week in the political realm. On Wednesday, markets decreased by over 1% after details surrounding former FBI Director James Comey’s dismissal were revealed. Markets fell as any reform agenda, whether health care, tax, or infrastructure, is now much less likely to be enacted for the time being. However, markets rallied on Friday as strong earnings from Deere & Co. helped push industrials 1.32% higher on the day. Q1 earnings have now grown by 14.3% versus the 8.7% originally expected.

Fixed Income

- The 10-year interest rate was down again last week as economic data largely disappointed. Housing starts and building permits both missed expectations and continued the recent trend of negative economic data. These misses were slightly offset by the strongest industrial production number since February 2014, as it grew by 1.0% MoM. The Citi Economic Surprise Index is now at its lowest point since May 2016.

Currencies

- The euro continued its recent trend higher last week, increasing by 2.52% versus the dollar to end the week at 1.12. European economic data continues to improve as CPI nears the ECB target of 2%. The Citi Economic Surprise Index in Europe shows a much different picture than in the US; the European Surprise Index sits at a very strong 59.5 and has not been below zero since September 2016. This is the longest time the measure has been above zero since March 2011. A reading above zero indicates that economic data is coming in better than expected.

- The dollar was also weaker versus the yen, with the yen increasing by 1.9% during Wednesday’s risk sell-off. The yen finished 1.87% higher at 111.26.

Commodities

- Oil rallied back above $50, increasing by 5.20% to end the week at $50.33. While all commodities received a benefit from the weaker dollar, oil experienced yet another positive inventory report on Wednesday. Overall inventories decreased by 1.75mn barrels, their sixth straight withdrawal, while gasoline inventories also decreased despite a 1.9% increase in refinery utilization. The report was overall very positive for oil, except for the continued increase in US production and rig count. There were also rumors of an extension of the OPEC production cut, with an official decision expected at OPEC’s upcoming meeting on May 25.

Economic Data Last Week

What to Watch for This Week

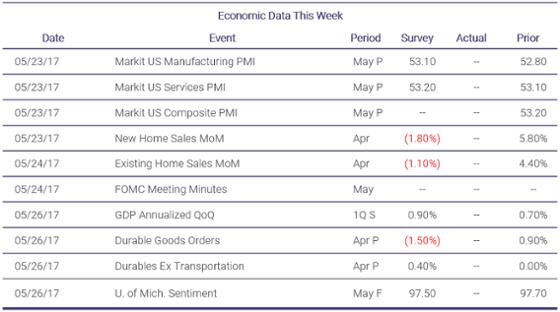

- The second revision to Q1 GDP caps off a busy week of economic data. The next three weeks will be extremely important for data releases, as markets still expect the Fed to raise rates at the June meeting.

- OPEC’s meeting on Thursday is expected to result in an extension of their current production cuts. Both Russia and Saudi Arabia have indicated they plan on voting to extend the cuts until 2018.

Economic Data This Week

Interesting Articles

- FT: Brazil shares tumble on Temer bribery claims

- Bloomberg: Wall Street Weighs In On Comey Memo

- Goldman Sachs Slightly Less Confident On June Hike

- FT: India stocks surge on Modi reforms

Disclaimer: All data and comments are as of May 19, 2017