Weekly Market Update, April 24-28

Week of April 24 – 28, 2017

Equities

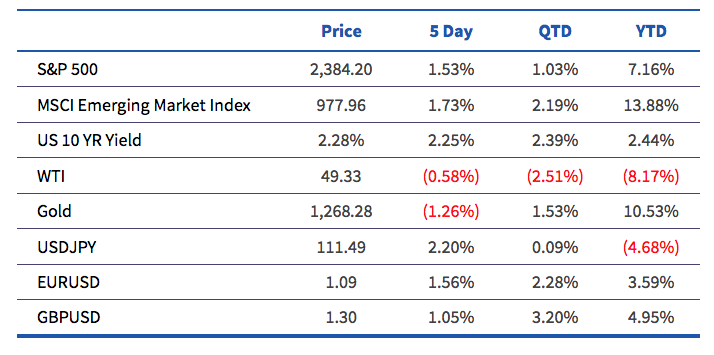

- The S&P 500 increased 1.53% last week as markets rallied due to a positive result in the French presidential election and tax reform continued to dominate headlines. Earnings were also much better than expected for many of the largest components in the index. The presidential administration finally produced some details on its plans for tax reform, and while most details are vague, the evidence of a plan caused markets to rally as they interpret that it is now more likely to have tax reform by the end of the year.

- 186 companies in the S&P 500 reported last week, with all but 34 beating expectations. Caterpillar, often seen as a bellwether for the industrial sector, more than doubled its EPS expectations and was a positive surprise on the week. Amazon and Google reported on Thursday evening, and both greatly surpassed expectations and rallied on Friday.

Fixed Income

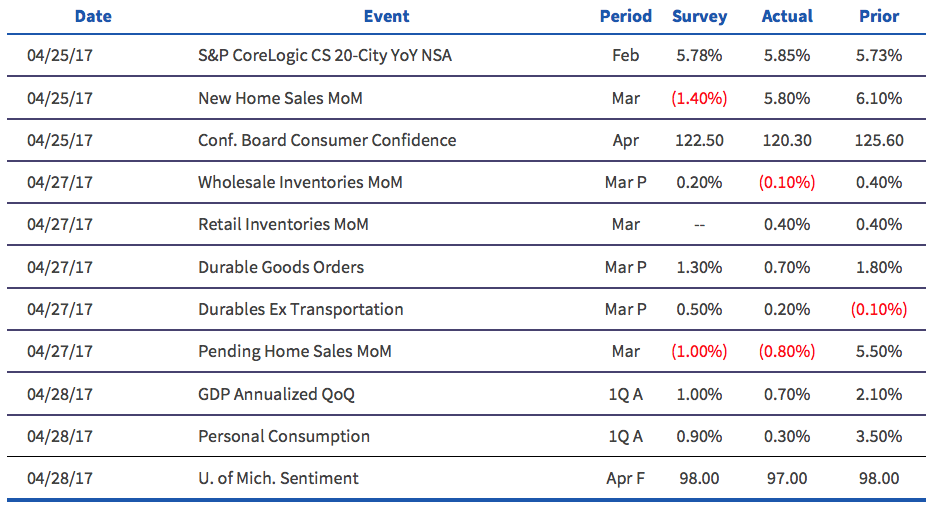

- Interest rates were higher across the curve last week despite very poor economic data. New home sales greatly surpassed expectations and are nearing a post-crisis high, but the positive housing data was offset by poor durable goods and GDP data. GDP for the first quarter was just 0.7%, missing expectations of 1%. Perhaps the most surprising aspect of the report was the 0.3% growth for personal consumption, its weakest growth rate since the fourth quarter of 2009. The weakness in GDP was broad based, with no one sector having an outsized impact on growth overall.

Currencies

- The dollar was weaker versus the euro after the euro rallied following the French election. Emmanuel Macron and Marine Le Pen will now face each other in a runoff election on May 7 after the candidates were the top two vote getters in the first round. This was largely as expected, but after polls had been wrong on the Brexit and US presidential votes there was significant uncertainty surrounding the vote.

- The risk on sentiment that was driven by the election results and the tax reform discussions caused a sell-off in the yen, as it decreased versus the dollar to end the week at 111.49.

Commodities

- Oil continued its recent trend, decreasing by 0.58% to end the week below $50 at $49.33. The inventory report followed last week’s trend: a drawdown in overall inventories, but a large build in gasoline inventories due to higher refinery utilization. This means that the larger than expected drawdown was nothing more than moving inventory from crude to gasoline, not a fundamental change in the market. US production and rig counts increased yet again, with rig counts now more than double their May 2016 low.

Economic Data Last Week

What to Watch for This Week

- The economic calendar is very busy again this week, with PCE, PMI, ISM, and the jobs report on Friday. The Fed also meets on Wednesday, but no action is expected at this meeting.

- It’s another busy week for earnings, with 122 companies reporting.

- The second round of the French presidential election is on Sunday. While it is widely expected that Macron will win the presidency, there is still the possibility Le Pen gains momentum this week.

- The European Central Bank meets on Thursday, but no changes in policy are expected.

Economic Data This Week

Interesting Articles

- Bloomberg: Congress Does Bare Minimum to Keep Government Open

- FT: Draghi fends off German critics and keeps stimulus untouched

- FT: French presidential election second round polls

- Bloomberg: Here’s What Wall Street Is Saying About Trump’s Tax Plan

Disclaimer: All data and comments are as of April 28, 2017